Content

What is a Virtual Wallet / Wallet ?

A virtual wallet is intended to keep the buyer's information in order to keep him loyal and to avoid him to enter his information again during a next order. It is used to store payment data and possibly the holder's private data.

Eligible cards

The types of cards that can be used for a wallet are the following: CB, VISA, MASTERCARD and AMERICAN EXPRESS

Regarding the AMERICAN EXPRESS Card: it is necessary that the merchant has contacted the bank AMERICAN EXPRESS, so that it can use recurring payments.

Verification process

When creating a wallet, Payline issues a € 1 authorization. This transaction is intended to verify the coordinates of the card (validity, opposition, etc ...).

This authorization is never debited. However, in rare cases (mainly Spanish banks), the holder could see the request for authorization on his bank account statement. The account is then re-credited at the end of the license's life, ie 7 days (this time depending on the issuers and the type of card).

To compensate for this behavior, Payline will now make "requests for information" instead of a 1 € authorization request.

New verification process

Payline will therefore send "requests for information": This is similar to the 1 € authorization request, except that the amount of the request is set at 0 €. Thus, the consumer will no longer view a debit on his statement of account.

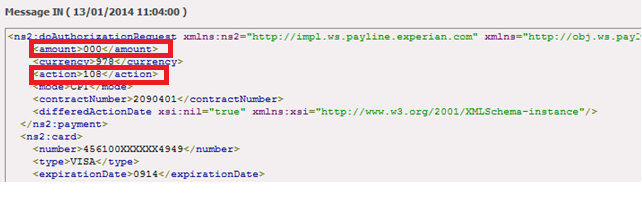

The action code of this "request for information" is 108 and the amount will be set to 0 €.

Example

Setup to be done in your contract

To generate these "requests for information", a modification must be made within the configuration of your contract.

The amendment will allow your contract to generate a "request for information" instead of an application for authorization.

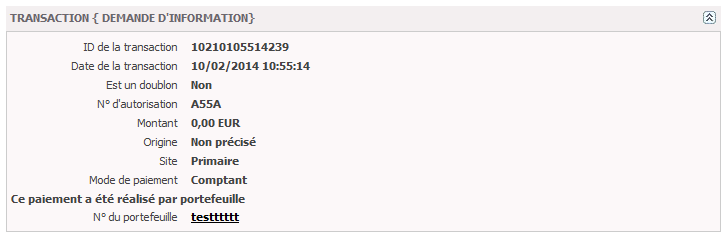

Viewing 'information requests'

From the Administration Center, by default, you will not see any requests for information in Searching Your Transactions. They will be visible only if you check "Transactions for creating / updating portfolios"

The "Transaction" block will be:

Wallet lifetime

A Portfolio has a life, which corresponds to the date of validity of the card of the holder.

A notification by email is sent to the merchant, as soon as the validity date of the Portfolio is equal to M-2, then every 15 days, you will receive a reminder notification, until the expiry date of the Portfolio.

Moreover, if you have entered in the tab your outlets then in the edition of a point of sale, the notification URL then a notification will be sent to the IS of the merchant two months before the expiry date.

The Portfolio will be purged from our systems 1 month after the expiry date of the Portfolio.

Wallet management

There are different ways to create, manage a portfolio, and execute a payment:

- by Web Page with one of the integration modes in-Shop, LightBox or Redirection using the createWebWallet service: see the detail of the integration ;

- by Direct Payment with one of the Direct or Ajax integration modes using the createWallet service: see the integration details ;

- by the Payline Administration Center : the administrator can list and modify the portfolios.

Return codes

The result codes of the operations are referenced in 01 or 02: see the list.

The possible return codes expected may be the following: during a payment.

Return Code | Message court | Message long | Targeted actor |

00000 | ACCEPTED | Transaction approved | All |

01100 | REFUSED | Transaction refused | Buyer |

01101 | REFUSED | Card expired | Buyer |

01103 | REFUSED | Contact your bank for authorization | Buyer |

02101 | ERROR | Internal Error | Merchant |

02102 | ERROR | External server communication error | Merchant |

02103 | ERROR | Connection timeout, please try later | Merchant |

02301 | ERROR | Transaction ID is invalid. | Merchant |

02302 | ERROR | Transaction is invalid. | Buyer |

02303 | ERROR | Invalid contract number. | Merchant |

02304 | ERROR | No transaction found for this token | Merchant |

02305 | ERROR | Invalid field format | Merchant |

02500 | ACCEPTED | Operation Successfull | All |

02501 | ACCEPTED | Operation Successfull but wallet will expire | Merchant |

02502 | ERROR | Wallet with the same identifier exist | Merchant |

02503 | ERROR | Wallet does not exist | Merchant |