Content

| Sommaire | ||||

|---|---|---|---|---|

|

Introduction to the concept of brand choice

Like most French bank cards, your credit card is certainly a CB card. What's more, it is surely backed by an international network such as Visa or MasterCard. Convenient when you are abroad. However, in France, where all CB merchants accept at least the CB, Visa and MasterCard networks, there should theoretically be a conflict between the French network and one of the other two. And neither the merchant nor you, participate in the resolution of the conflict by selecting one of the networks. So which one is chosen? Should not one be able to take the network of one's choice when possible? This is part of the 2016 Resolution of the European Payment Services Directive Version 2 (DSP2).

Current operation

CB credit cards backed by an international network such as MasterCard or Visa can operate on one of the two networks (CB or MasterCard / Visa). In addition, French CB traders must accept these networks. On the other hand, since the CB network has priority over the other, an international CB card (CB MasterCard or CB Visa) carrying out a transaction in France will be done automatically on the French network.

Note: this operation does not apply to "only" cards. These are cards issued in France with only the MasterCard or Visa application. In fact, even in France, the transaction will not be processed by CB.

Tomorrow, the carrier will choose

However in mid-2016, a European regulation will impose to leave the choice to the bearer. Thus he will be able to select the French or international network. In principle, it is difficult to criticize this possibility offered to the bearer when he contributes for a card with multiple brands.

However, this choice, as innocuous as it may be, can be fraught with consequences. If a priori, this should not change much (eventually) for the merchant about commissions (CIP for CB and CMI for MasterCard / Visa) following the cap on commissions; this could be more detrimental for the CB payment system and therefore the banks.

Indeed, for the common man or for those who do not have the chance to know this blog, MasterCard and Visa are better known brands than CB and therefore safer. It's a safe bet that they will choose international networks. According to our information, 65% of consumers with a credit card click on Visa or Mastercard when choosing the card on a payment page.

The Payline proposal

Payline allows:

- the merchant to define the brand to use by default in the Payline contract, with the mark to be used by default for each type of card and the possibility to let the buyer make his own choice (not possible by default);

- that consumer choice predominates;

- payments by wallet, then the choice of the merchant possibly modified by the purchaser, is stored in the wallet;

- that the transaction benefits from monetary and regulatory conditions related to the brand (% interchange, period of validity, management of outstanding payments).

This consists in proposing the choice of the brand to the consumer via the different payment interfaces:

- Tpev: authorization functions and portfolio creation functions;

- Backoffice: function to create a manual transaction;

- Web pages: payment page and registration page of a card in a wallet;

- Web service: payment via webpage of payment and by direct interface, creation / modification of wallet, payment, payment by wallet;

- Batch: authorization request function.

The means of payment concerned are the following:

MEANS OF PAYMENT | Possible choices |

|---|---|

CB/VISA/MASTERCARD | CB ; VISA/MCD |

BCMC | BCMC; TEACHER |

Payline configuration

Default choice of the trader

In the payline backoffice payment method setup screen, the merchant defines the brand to use by default based on the card type.

From the moment the choice of the merchant is configured, all the transactions are carried out with this default mark unless the consumer chooses another one.

Consumer choice

In this same screen, the merchant activates, if he wishes, the choice to the consumer on the pages Payline. He may not offer it when this choice is made in his shop.

Brand selection made on Payline pages

Payline searches after entering the first 10 numbers of the card, the default mark chosen by the merchant and displayed on the payment page.

Payment page v1

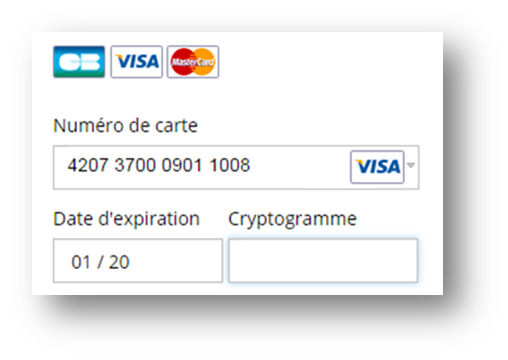

A green frame surrounds the brand used. By clicking on another logo, the consumer can choose the brand to use.

Payment page v2

The brand logo is displayed in the card number field. By clicking on the logo, a list appears the consumer can fall another brand.

Payment tickets in APIs

Brand selection made in the shop of the merchant

The merchant sends Payline the choice made by the consumer during the payment request by filling in the cardBrand field of the Payment and Wallet items with one of the following values:

- CB = 0

- VISA = 1

- MASTECARD = 4

- MAESTRO = 5

- BCMC = 8

Payline will not offer the choice of the brand on the payment page and will use the choice sent by the merchant.

The API webservices

Payline web service | comments |

Allow the merchant to transmit the brand to use (new field payment.Cardbrand ) It is taken into account only if the means of payment allows the choice of the mark. If the payment.Cardbrand information is not present, then Payline uses the default mark configured in the contract. | |

Payline returns: 1) in the network field of the extendedCardType object the network actually used by the transaction 2) in the Cardbrand field of the Payment object the value present in the request. | |

Payline returns the network to use in the extendedCardType and wallet cardbrand network fields . | |

Payline allows the merchant to transmit the brand to use (new field payment .CardBrand). It is taken into account only if the means of payment allows the choice of the mark. If the payment.Cardbrand information is not present, then Payline uses the default mark configured in the contract. | |

createWallet | Payline allows the transmission of the brand in the new wallet field .cardbrand (new) It is taken into account only if the means of payment allows the choice of the mark. If the Wallet.Cardbrand information is not present, then Payline uses the default mark configured in the contract. The response message is not modified. |

Idem createWallet | |

Payline returns the network to use in the extendedCardType .network and wallet .cardbrand fields | |

Payline returns the network to use in the fields cardslist .cards and extendedCardType .network | |

Payline returns: 1) in the extendedCardType .network field the network actually used by the transaction. 2) in the payment .brand field the value present in the request. |

The creation / modification screen of a wallet obtained after a call to manageWebWallet is modified at the entry level of the map coordinates as step 2 for the payment pages (widget and classic).

Recurring REC or NX payment or wallet payment via web service, Payline sends the authorization request with the data attached to the wallet.

Limitation and constraints

The customization of the logos of the means of payment is always possible but must not change the order for the payment pages v1.

Test card

The card 4974132154654656 allows a choice CB / VISA by the buyer on the payment interface in environment of approval.