Content

More information

How do configure your account ?

You must contact your account manager to obtain the necessary information to configure your account on Payline (contract and name of the bank).

Then please send an email to our support team with the information, so that they can proceed with the settings in your Payline merchant account, indicating the Merchant ID and the name of the alias of the partner contract to be created.

You must carry out 'pilot' transactions to validate an operation in production.

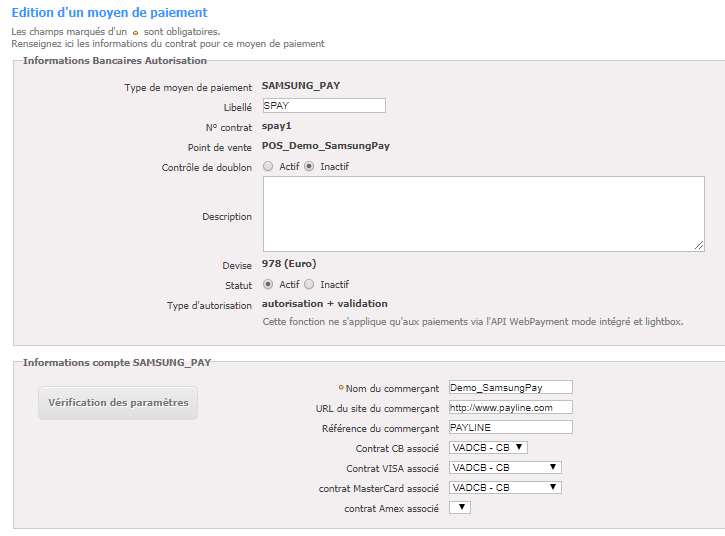

In the Payline administration center, when creating the payment method, the fields to configure are the Visa and Mastercard contract numbers.- In Web API or PG Checkout integration: the merchant will use service ID (SID) and Payline Certificate Signing Request (CSR) (recommended).

In Direct API or Merchant checkout integration: the merchant must retrieve his service ID (SID) from the Partner Portal and communicate the Certificate Signing Request (CSR) via this same channel. The merchant communicates the test / production IP addresses via the Partner Portal so that Samsung Pay can declare them in the system.

To set up Samsung Pay on Payline, you need to create a Samsung Pay account in SellerCentral and retrieve the Merchant ID, NWS Authorization Token, and Customer ID information needed to set up your Payline contract.

To create a Samsung Pay account please refer to the Samsung Pay documentation and follow the detailed procedure (DirectPayment API).

How to offer Samsung Pay to your customers ?

Principles of use

Once the payment method has been activated, it can be used through the standard Payline functions by indicating the contract for the Contrat_Number payment method.

The integration mode is available with the WebPayment API : doWebPayment and getWebPaymentDetails services.

The mode of integration with the DirectPayment API with the doAuthorization service.

Once the payment method has been activated, it can be used through the standard Payline functions.

Web services in Web mode (PG checkout)

There is no need for any interaction between the merchant and Samsung.

Likewise, there is no need to declare the merchant's IP address.

- Payment interfaces: WebPayment API.

- Payment on order: using the doWebPayment service with payment Mode code at CPT and Action code at 101.

- Payment on shipment: using the doWebPayment and doCapture services with the Mode code at CPT and the Action code at 100.

- Payment method: full, deferred, with the Mode code = CPT and DIF.

- Request for cancellation : using the doReset service allows the merchant to request the total or partial cancellation of the order.

- Refund request : use the doRefund service to refund the order.

- The re-authorization request with the doReauthorization service.

- Fraud module : rules on the transaction, the buyer and the CB payment method, Visa, Mastercard.

The type of wallet

OK transactions are flagged on the CB contract associated with a type of Samsung Pay wallet.

KO transactions are flagged either :

- On a Samsung Pay contract if it is an error returned by the wallet type payment method;

- On a CB contract if it is an error returned by the purchaser.

In both cases, you may observe that the transaction.externalWalletType field contains the value SAMSUNG_PAY.

Web services in Direct mode

The services available : the doAuthorization service to realize a payment request.

The merchant must refer to the Samsung Pay documention in the “Samsung Pay Web Checkout” category.

Required fields

Mandatory fields must be completed when requesting payment, otherwise the request will be refused.

| Name | Type |

|---|---|

Id transaction | Description |

PAN card | PAN masked |

| Expiration date | Date |

| Amount | Amount with currency |

| Currency | Transaction currency |

| Order.Ref | Max 36 char : [A-Z][a-z][0-9,-] |

| ReturnURL | Payment return URL |

How to carry out tests ?

To perform a test, you must have a Samsung smartphone compatible with the Samsung Pay application:

Samsung Galaxy S10, S10+ et S10e

Samsung Galaxy S9 et S9+

Samsung Galaxy S8 et S8+

Samsung Galaxy S7 et S7 Edge

Samsung Galaxy Note 8

Samsung Galaxy A8 2018

Samsung Galaxy A5 2017

Samsung Galaxy A6, A6+, A7, A8 et A9

The applications provided by SamsungPay must have been installed on the phone in factory settings and without updating, in accordance with their installation procedure.

En intégration API Web ou PG checkout : - Il n’y a pas besoin d’interaction entre le commerçant et Samsung En intégration API Direct ou Merchant checkout : - Le commerçant doit récupérer son service ID (SID) de la même manière que vous l’avez fait sur le Partner Portal et nous communiquer Certificate Signing Request (CSR) via ce même canal Guide d'installation des applications (suivre Staging) Application à installer sur le téléphone

Cette page résume la procédure : 3. Avoir les cartes de tests fournies par SamsungPay enregistrées dans le wallet. Les cartes fournies sont des cartes VISA uniquement : Exp Date : 12/22

4. PIN code de l'application SGP pour finaliser la transaction sur le téléphone: 1020 |

Return codes

With the WebPayment API, Payline informs you of payment result via the ShortMessage of the getWebPaymentDetails services.

With the DirectPayment API, Payline notifies you of result synchronously in response to getTransactionDetails service.

When the payment is accepted, Payline returns the ShortMessage = ACCEPTED.

For a refused payment, the code varies according to the reason for refusal (For example: 04xxx for a suspected fraud).

The return codes are extracted from the Payline Front return codes.

Specific codes:

| Payline Code | ShortMessage | LongMessage |

|---|---|---|

| 02500 | ACCEPTED | Operation Successfull |

| 00000 | ACCEPTED | Transaction Successfull |

| 02008 | CANCELLED | Transaction canceled by user |

| 02020 | REFUSED | Transaction refused by partner |

| 02101 | ERROR | System internal error (frontend) |

| 02102 | ERROR | Acquirer server communication error |

| 02324 | REFUSED | The session expired before the consumer has finished the transaction |

| 02106 | ERROR | Payment partner error |

| 02012 | ERROR | Unmatched partner return code |

| 02305 | ERROR | Invalid field format |

| 02308 | ERROR | Invalid value for |

| 02021 | REFUSED | Fraud detected by partner. Transaction refused. |

| 02006 | ONHOLD_PARTNER | Retry in progress, please wait for payment status |

| 02016 | ONHOLD_PARTNER | Transaction hold on partner, please wait for payment method return |

| 02000 | ONHOLD_PARTNER | Transaction in progress, please wait for payment status |

| 02010 | ERROR | Requested function not available |