Presentation

In Widget mode, Payline offers 3 types of processing to manage subscription or recurring payments :

- Payline manages the schedule indicated by the merchant ;

- The merchant manages the schedule and uses the wallet (walletID) ;

- The merchant manages the schedule and uses the Tokenization (TokenPan).

Subscription payment: managed by Payline

Payline offers the management of subscription / recurring payments by relying on the Payline schedule management engine : the merchant programs the deadlines in Payline when the customer takes out a subscription.

The card debit date is chosen by the merchant when creating the schedule.

The payment process

- The consumer fills in his card and validates his order.

- The merchant information system call a doWebPayment web service call to create a payment schedule with REC mode and indicating the schedule (see recurring object : periodicity, date and 1st due date, amount following due dates).

From the second purchase

- The deadlines are created by Payline process. On each creation, Payline calls your notification URL (passed as a parameter of doWebPayment or defined in the administration center) with the parameters described in the notification. This call should trigger a call to getPaymentRecord from you to know the subscription progress.

Subscription payment: managed by the merchant's system with Payline wallets

By taking charge of the deadlines directly at the level of the merchant's IS, the debit orders on the cards are sent directly to Payline (by web service).

The first installment payment process is as follows

- The merchant's IS contacts Payline via doWebPayment service to initiate a payment request and card registration. The merchant's IS assigns each customer a unique identifier which represents the virtual wallet.

- The shopper fills in his card and validates his order. There is no need to give consent for the storage of payment data due to the subscription offer.

- Payline carries out the transaction and stores the card data in a wallet.

- The merchant's IS retrieves the result of the payment via the getWebPaymentDetails service.

From the second installment payment, the payment process is

- The merchant's IS contacts Payline via the doImmediateWalletPayment service to request an authorization for the amount of the due date, specifying the walletID concerned.

- Payline carries out the transaction and gives its response in real time to the function.

Complementary function

- Payline notifies the merchant's IS when the card expires or when it is opposed.

- Payline provides a management service for cards stored in a wallet via the manageWebWallet service.

Subscription payment: managed by the merchant with Tokenization

By taking charge of the deadlines directly at the level of the merchant's IS, the debit orders on the cards are sent directly to Payline (by web service).

The first installment payment process is as follows

The merchant's IS contacts Payline via the doWebPayment service to initiate a payment request.

- The shopper fills in his card and validates his order. There is no need to give consent for the storage of payment data due to the subscription offer.

- Payline performs the transaction and builds a unique TokenPan alias of the card number.

- The merchant's IS retrieves the result of the payment as well as the TokenPan via the getWebPaymentDetails service.

From the second purchase, the payment process is as follows

- The merchant's IS contacts Payline via the doAuthorization service with the TokenPan and the expiration date to realize an authorization request for the amount due.

- Payline carries out the transaction and gives its response in real time to the function.

The creation of deadlines is carried out at the times indicated below:

PRODUCTION

- Active between 1h and 3h

- Between 6 a.m. and 8 a.m.

- Between 2 p.m. and 6 p.m.

- Between 10 p.m. and midnight

TEST

- Active between midnight and midnight

The execution of the deadlines is carried out at 00:30.

The timetable display

The function in Widget mode is:

Payline.Api.getRecurringDetails().schedules;

The format of the schedule:

{

"type": "REC",

"billingNumber": 20,

"firstAmount": "5,00 EUR",

"billingCycle": "Hebdomadaire",

"amount": "5,00 EUR",

"firstBillingDate": "23/05/2018",

}

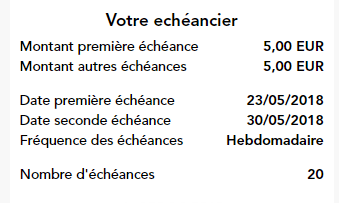

The payment page display summarizes the schedule information:

The payment receipt contains the information of the payment schedule:

Notification of deadlines

You have the possibility of being alerted on a notification Url of your choice following the debit of each of the deadlines.

Payline also offers to send an email, fully customizable, to your buyer following the debit of each of the deadlines.

These two features are configurable in our Payline backoffice.

Notification of payment due to the merchant

This functionality must be configured in the Payline administration center in the "Configuration" / "Your points of sale" / "Editing a point of sale" tab.

To do this, you must enter a notification URL or provide us with a notification URL in the call to Payline web services and check the "Notification of payments due" box.

List of parameters transmitted by Payline on the notification URL as part of a payment due:

- notificationType=BILL

This setting tells you the payment type for which you are being notified.

"BILL" corresponds to the value provided for a payment due:

- paymentRecordId=185321

This is the payment file number grouping together all the deadlines:

- walletId=1HJb16UJMFmOuD5tCiWS1378738513330

Wallet ID used during payment. In this example, it is an implicit wallet:

- transactionId=10909165550386

Transaction ID:

- billingRecordDate=20130909

Payment date of the due date:

- orderRef=REF004000112

Order reference transmitted during the initialization of payment by the merchant.

Complete example of a deadline notification URL:

Notification to the buyer of the various deadlines

Payline offers you to notify the consumer during each direct debit by email.

You completely personalize this email (content, logo, variables available in the body of the email).